How to protect yourself from phone fraud: advice from St Petersburg University expert

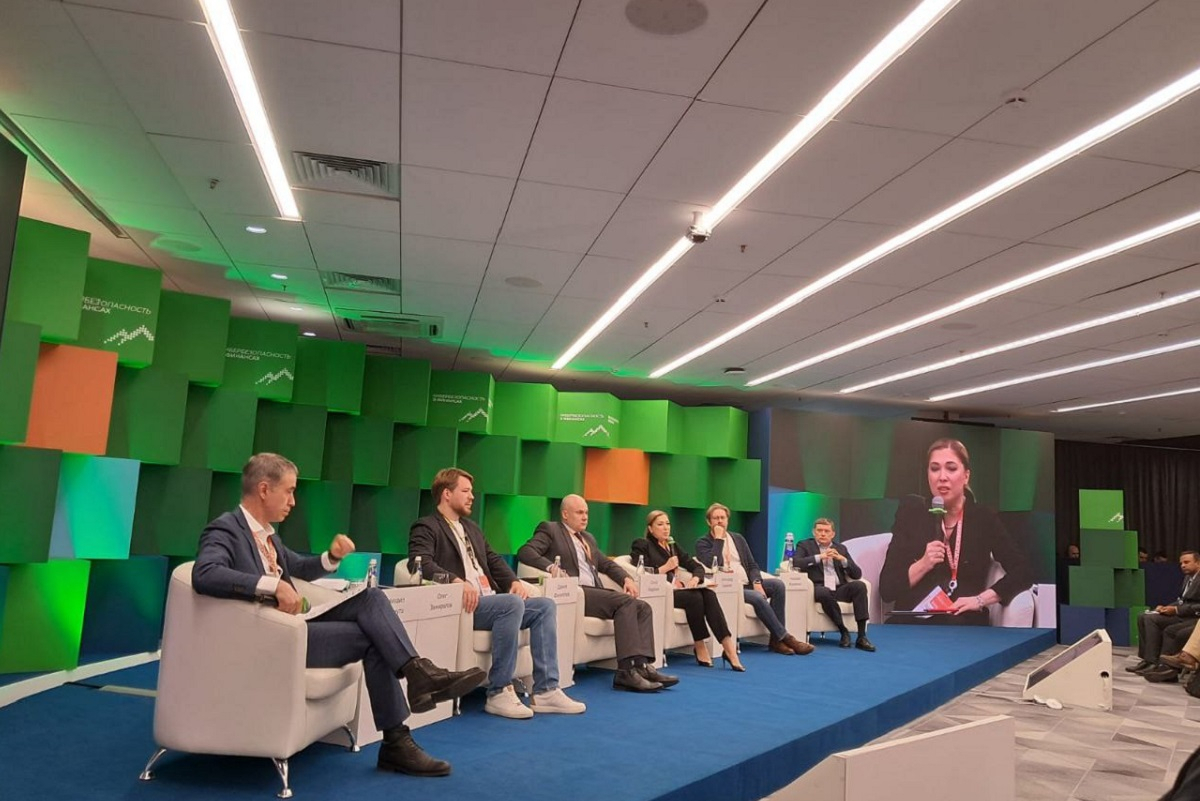

The Ural Forum "Cybersecurity in Finance — 2025" discussed how anti-fraud systems work to protect clients of financial organisations from scammers. These systems ensure that every transaction undergoes strict control. Olga Medyanik, Associate Professor in the Department of Risk Management and Insurance at St Petersburg University, participated in the forum as an expert in risk management and economic psychology.

In his opening remarks during the panel discussion "Digital immunity: a vaccine against cyber fraud", Mikhail Mamuta, a member of the Board of Directors of the Bank of Russia, highlighted that banks are enhancing their anti-fraud systems by actively employing neural networks and artificial intelligence to protect financial clients. Similarly, psychologists and law enforcement agencies are analysing the profiles of criminals and victims to identify vulnerabilities and opportunities for better protection. They share their findings and recommendations with financial institutions.

Individuals who are unaware of the psychological tactics employed by scammers are particularly vulnerable to financial fraud. As an example, participants listened to audio recordings of actual telephone conversations, demonstrating how attackers manipulate people’s emotions and fears. Following this, the expert was asked to provide insights on how citizens can protect themselves and how banks can safeguard their clients from financial and data loss.

Olga Medyanik, Associate Professor in the Department of Risk Management and Insurance at St Petersburg University, discussed the psychological aspects of communication between scammers and their victims.

The forum participants reviewed a recording where the victim, despite reasoning quite sensibly, ultimately followed the fraudster’s instructions. What special techniques and methods do scammers employ in their criminal schemes?

Analysis of scammers’ scripts and conversations suggests that they were likely to have been crafted by professional psychologists or psycholinguists. These scripts are expertly designed using principles of neurolinguistic programming (NLP) and cognitive behavioural psychology. It is possible that these scripts have been enhanced with manipulation techniques by so-called side-hustling psychologists to influence the emotions, feelings, and subconscious of potential victims. This is why almost anyone can be susceptible to such attacks, even those who believe they cannot be deceived.

The research project titled "Behavioural strategies of consumers of financial services in the context of cyberfraud: an interdisciplinary" was supported by a grant from the Russian Science Foundation (No 23-28-00701).

Scammers manipulate a person’s mental state using specific strategies and techniques. While conversation scripts can now be drafted by artificial intelligence, they are then refined by professional psychologists. Thus they are transformed from ordinary texts into persuasive tools designed to influence the target’s actions.

How do fraudsters manipulate a victim’s thoughts and emotions to control them? What specific tools and techniques do they employ?

Scammers not only use persuasive language techniques but they also manipulate the victim’s emotions. Their primary goal is to induce physiological reactions. Victims are targeted on three levels: cognitive (controlling thoughts); emotional (exploiting feelings); and physiological (triggering hormonal changes). By activating cognitive and emotional responses, they stimulate the sympathetic nervous system, leading to the release of stress hormones: adrenaline, noradrenaline, and cortisol. In some individuals, these hormonal changes can impair rational decision-making, with effects potentially lasting for several days.

Your in-depth analysis of audio recordings that feature telephone scammers interacting with their victims is genuinely thought-provoking. Could you please explain which aspects the scammers focus on to confuse people and achieve their goals?

Through analysing numerous scripts, we identified the primary coding methods used for manipulation. The scammer often poses as a bank or law enforcement officer to build trust, creating a false sense of authority and suggesting they possess important confidential information about the victim. The scammer then seeks to control the situation and ensure the victim is alone, preventing outside interference. Then, scammers introduce a false reality with fictitious concepts and terms, references to government agencies, and official documents (such as the Federal Security Service, the Federal Financial Monitoring Service, or articles of the Russian Federation Criminal Code to name just a few). Scam victims experience confusion and anxiety giving them a sense of urgency and gravity of the situation. They are offered a "solution" to the problem while being pressured to act immediately. Scammer bombard victims with accusations of criminal involvement and threats of consequences for inaction. Neurolinguistic programming techniques (such as the repetition of key phrases) further intensify the victims’ sense of helplessness, driving them to comply with the scammer’s demands.

What measures have been implemented to protect citizens from telephone scammers, considering the impact of these attacks on the human psyche?

Understanding how fraudsters influence victims’ psychological state helps in developing effective countermeasures. One outcome of the grant-funded research is the practical guide titled "Communicating with victims of financial abuse: educational and methodological recommendations and a workshop for bank employees". This publication teaches the readers how to expertly recognise and prevent fraud. It serves as a key resource for protection against financial manipulation and provides effective strategies to counter psychological pressure and coercion.

Notably, the research findings were taken into consideration when the Government of the Russian Federation made an important decision aimed at protecting citizens from telephone scammers. The law enacted on 25 July 2024 requires banks to suspend transfers for two days if the recipient’s information is listed in the Bank of Russia’s database of cases and attempts of fraudulent transactions. Additionally, a recently passed law by the State Duma establishes a "cooling-off period" for loans and credits, effective from 1 September 2025. This period will allow individuals to reassess their circumstances and make informed decisions.

These measures provide potential fraud victims with time to reflect and recognise possible manipulation.